window._wpemojiSettings = {"baseUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/72x72\/","ext":".png","svgUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/svg\/","svgExt":".svg","source":{"concatemoji":"https:\/\/www.dbalawyers.com.au\/wp-includes\/js\/wp-emoji-release.min.js?ver=27fe84cc702a2d02d851b8f2a8bba567"}};

/*! This file is auto-generated */

!function(i,n){var o,s,e;function c(e){try{var t={supportTests:e,timestamp:(new Date).valueOf()};sessionStorage.setItem(o,JSON.stringify(t))}catch(e){}}function p(e,t,n){e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(t,0,0);var t=new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data),r=(e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(n,0,0),new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data));return t.every(function(e,t){return e===r[t]})}function u(e,t,n){switch(t){case"flag":return n(e,"\ud83c\udff3\ufe0f\u200d\u26a7\ufe0f","\ud83c\udff3\ufe0f\u200b\u26a7\ufe0f")?!1:!n(e,"\ud83c\uddfa\ud83c\uddf3","\ud83c\uddfa\u200b\ud83c\uddf3")&&!n(e,"\ud83c\udff4\udb40\udc67\udb40\udc62\udb40\udc65\udb40\udc6e\udb40\udc67\udb40\udc7f","\ud83c\udff4\u200b\udb40\udc67\u200b\udb40\udc62\u200b\udb40\udc65\u200b\udb40\udc6e\u200b\udb40\udc67\u200b\udb40\udc7f");case"emoji":return!n(e,"\ud83d\udc26\u200d\u2b1b","\ud83d\udc26\u200b\u2b1b")}return!1}function f(e,t,n){var r="undefined"!=typeof WorkerGlobalScope&&self instanceof WorkerGlobalScope?new OffscreenCanvas(300,150):i.createElement("canvas"),a=r.getContext("2d",{willReadFrequently:!0}),o=(a.textBaseline="top",a.font="600 32px Arial",{});return e.forEach(function(e){o[e]=t(a,e,n)}),o}function t(e){var t=i.createElement("script");t.src=e,t.defer=!0,i.head.appendChild(t)}"undefined"!=typeof Promise&&(o="wpEmojiSettingsSupports",s=["flag","emoji"],n.supports={everything:!0,everythingExceptFlag:!0},e=new Promise(function(e){i.addEventListener("DOMContentLoaded",e,{once:!0})}),new Promise(function(t){var n=function(){try{var e=JSON.parse(sessionStorage.getItem(o));if("object"==typeof e&&"number"==typeof e.timestamp&&(new Date).valueOf()<e.timestamp+604800&&"object"==typeof e.supportTests)return e.supportTests}catch(e){}return null}();if(!n){if("undefined"!=typeof Worker&&"undefined"!=typeof OffscreenCanvas&&"undefined"!=typeof URL&&URL.createObjectURL&&"undefined"!=typeof Blob)try{var e="postMessage("+f.toString()+"("+[JSON.stringify(s),u.toString(),p.toString()].join(",")+"));",r=new Blob([e],{type:"text/javascript"}),a=new Worker(URL.createObjectURL(r),{name:"wpTestEmojiSupports"});return void(a.onmessage=function(e){c(n=e.data),a.terminate(),t(n)})}catch(e){}c(n=f(s,u,p))}t(n)}).then(function(e){for(var t in e)n.supports[t]=e[t],n.supports.everything=n.supports.everything&&n.supports[t],"flag"!==t&&(n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&n.supports[t]);n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&!n.supports.flag,n.DOMReady=!1,n.readyCallback=function(){n.DOMReady=!0}}).then(function(){return e}).then(function(){var e;n.supports.everything||(n.readyCallback(),(e=n.source||{}).concatemoji?t(e.concatemoji):e.wpemoji&&e.twemoji&&(t(e.twemoji),t(e.wpemoji)))}))}((window,document),window._wpemojiSettings);

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery.min.js

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery-migrate.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/third-party.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/modernizr.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/general.min.js

jQuery(document).ready(function($){

// Check if the body has the specified class

if($('body.postid-15293').length) {

// If it does, replace the HTML content of h1.title.entry-title

$('h1.title.entry-title').html('<h1 class="title entry-title">New decision highlights options for disqualified persons: <i>Barry, in the matter of an application by Barry</i> [2024] FCA 13</h1>');

}

});

jQuery(document).ready(function( $ ){

$('.attachmentid-2444 p.attachment a').attr('href','https://www.dbalawyers.com.au/stamping_memo.pdf');

});

/* Default comment here */

jQuery(document).ready(function( $ ){

$(".page-id-3527 .post-12207 img").attr("src","/wp-content/uploads/2021/05/CPA-Logo-1400x656-2-e1621498237883.jpg");

});

jQuery(document).ready( function($){

$( '.responsiveMenuSelect' ).change(function() {

var loc = $(this).find( 'option:selected' ).val();

if( loc != '' && loc != '#' ) window.location = loc;

});

//$( '.responsiveMenuSelect' ).val('');

});

var switchTo5x=true;

Co-author by Daniel Butler, Director, DBA Lawyers Introduction We have had numerous queries about the proportioning rule over recent times. A common query is how does the proportioning rule apply and how do you calculate the tax free and taxable components in a superannuation benefit. This article is to assist you understand the fundamentals of [read more]

The biggest changes to superannuation in a decade will take effect from 1 July 2017, due to the Treasury Laws Amendment (Fair and Sustainable Superannuation) Act 2016 (Cth). There are several cases from the past that are particularly relevant for these changes. In this article I detail why some of these changes and why they matter, [read more]

The rules relating to superannuation contributions are constantly changing. Consider, for example, a deceptively simple question: How much after tax contributions can a person make? Depending on when in the last 11 years this question was asked, there have been at least four answers and there will soon be a fifth answer. Similarly, consider for [read more]

This article examines whether an SMSF can acquire shares offered under an employee share scheme (‘ESS’). What is an ESS? Broadly, an ESS (also known as an employee share plan or employee share ownership plan) typically gives employees the opportunity to purchase shares in their employer. Usually, employees are able to obtain more favourable terms [read more]

On Friday 14 October 2016, Treasury released the third tranche of draft legislation to implement the announcements in the Federal Budget. The principal component of this tranche was the new non-concessional contribution rules. Hidden in the legislation is a very important concession. I envisage that advisers will only need to apply it a handful of times [read more]

By: Daniel Butler, Director, DBA Lawyers On 15 September 2016 the Government, following four months of considerable adverse feedback on its $500,000 lifetime non-concessional contributions (‘NCCs’) cap proposal announced on 3 May 2016, has decided to drop this measure (which was retroactive to 1 July 2007) for a more palatable and prospective contributions limit that [read more]

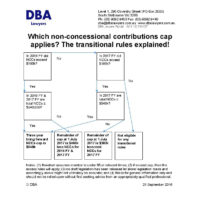

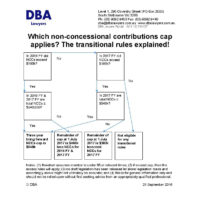

I have put together this flowchart explaining the new non-concessional contribution (‘NCC’) rules, in particular how clients will transition to the new rules come 1 July 2017. I suspect all advisers will have clients for whom this information is relevant and many client might want to make large NCCs before 1 July 2017. We will [read more]

One of the most disturbing aspects of the $500k lifetime non-concessional contribution (NCC) cap announced in the 3 May 2016 Federal Budget is that it catches prior NCC’s made since 1 July 2007. The Government denies this proposal is retrospective. We outline below a range of reasons why the Government should remove the retroactive application [read more]

We are about to enter a period of substantial reform. We have therefore prepared a brief ‘stock take’ of what the reform proposals look like as at the start of July 2016. In particular, we consider the proposals announced in the 3 May 2016 Federal Budget by the Liberal Government. We also briefly compare these [read more]

ATO extends the deadline to 31 January 2017 The ATO extension to 31 January 2017 is most welcome to alleviate the concerns that many SMSFs are facing in view of the need to act swiftly to clean up related party and non-bank limited recourse borrowing arrangements (‘LRBA’). Many SMSFs in particular have had to look [read more]

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+"://platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

console.log('Rob Info Shortcode Source:', jQuery('*[data-rob-info]').html());

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/hoverIntent.js

var uberMenuSettings = {"speed":"100","trigger":"hoverIntent","orientation":"horizontal","transition":"slide","hoverInterval":"20","hoverTimeout":"400","removeConflicts":"on","autoAlign":"off","noconflict":"off","fullWidthSubs":"off","androidClick":"off","iOScloseButton":"on","loadGoogleMaps":"off","repositionOnLoad":"off"};

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/ubermenu.min.js

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/swv/js/index.js

var wpcf7 = {"api":{"root":"https:\/\/www.dbalawyers.com.au\/wp-json\/","namespace":"contact-form-7\/v1"},"cached":"1"};

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/js/index.js

window.addEventListener("load", function(event) {

jQuery(".cfx_form_main,.wpcf7-form,.wpforms-form,.gform_wrapper form").each(function(){

var form=jQuery(this);

var screen_width=""; var screen_height="";

if(screen_width == ""){

if(screen){

screen_width=screen.width;

}else{

screen_width=jQuery(window).width();

} }

if(screen_height == ""){

if(screen){

screen_height=screen.height;

}else{

screen_height=jQuery(window).height();

} }

form.append('<input type="hidden" name="vx_width" value="'+screen_width+'">');

form.append('<input type="hidden" name="vx_height" value="'+screen_height+'">');

form.append('<input type="hidden" name="vx_url" value="'+window.location.href+'">');

});

});

stLight.options({publisher: "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", doNotHash: false, doNotCopy: false, hashAddressBar: false});

var options={ "publisher": "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", "position": "right", "ad": { "visible": false, "openDelay": 5, "closeDelay": 0}, "chicklets": { "items": ["facebook", "googleplus", "twitter", "linkedin", "email", "sharethis"]}};

https://www.dbalawyers.com.au/wp-content/themes/canvasChild/js/jquery.cycle2.min.js