window._wpemojiSettings = {"baseUrl":"https:\/\/s.w.org\/images\/core\/emoji\/14.0.0\/72x72\/","ext":".png","svgUrl":"https:\/\/s.w.org\/images\/core\/emoji\/14.0.0\/svg\/","svgExt":".svg","source":{"concatemoji":"https:\/\/www.dbalawyers.com.au\/wp-includes\/js\/wp-emoji-release.min.js?ver=eae3ad3c3308e88261851db62ab775ee"}};

/*! This file is auto-generated */

!function(i,n){var o,s,e;function c(e){try{var t={supportTests:e,timestamp:(new Date).valueOf()};sessionStorage.setItem(o,JSON.stringify(t))}catch(e){}}function p(e,t,n){e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(t,0,0);var t=new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data),r=(e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(n,0,0),new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data));return t.every(function(e,t){return e===r[t]})}function u(e,t,n){switch(t){case"flag":return n(e,"\ud83c\udff3\ufe0f\u200d\u26a7\ufe0f","\ud83c\udff3\ufe0f\u200b\u26a7\ufe0f")?!1:!n(e,"\ud83c\uddfa\ud83c\uddf3","\ud83c\uddfa\u200b\ud83c\uddf3")&&!n(e,"\ud83c\udff4\udb40\udc67\udb40\udc62\udb40\udc65\udb40\udc6e\udb40\udc67\udb40\udc7f","\ud83c\udff4\u200b\udb40\udc67\u200b\udb40\udc62\u200b\udb40\udc65\u200b\udb40\udc6e\u200b\udb40\udc67\u200b\udb40\udc7f");case"emoji":return!n(e,"\ud83e\udef1\ud83c\udffb\u200d\ud83e\udef2\ud83c\udfff","\ud83e\udef1\ud83c\udffb\u200b\ud83e\udef2\ud83c\udfff")}return!1}function f(e,t,n){var r="undefined"!=typeof WorkerGlobalScope&&self instanceof WorkerGlobalScope?new OffscreenCanvas(300,150):i.createElement("canvas"),a=r.getContext("2d",{willReadFrequently:!0}),o=(a.textBaseline="top",a.font="600 32px Arial",{});return e.forEach(function(e){o[e]=t(a,e,n)}),o}function t(e){var t=i.createElement("script");t.src=e,t.defer=!0,i.head.appendChild(t)}"undefined"!=typeof Promise&&(o="wpEmojiSettingsSupports",s=["flag","emoji"],n.supports={everything:!0,everythingExceptFlag:!0},e=new Promise(function(e){i.addEventListener("DOMContentLoaded",e,{once:!0})}),new Promise(function(t){var n=function(){try{var e=JSON.parse(sessionStorage.getItem(o));if("object"==typeof e&&"number"==typeof e.timestamp&&(new Date).valueOf()<e.timestamp+604800&&"object"==typeof e.supportTests)return e.supportTests}catch(e){}return null}();if(!n){if("undefined"!=typeof Worker&&"undefined"!=typeof OffscreenCanvas&&"undefined"!=typeof URL&&URL.createObjectURL&&"undefined"!=typeof Blob)try{var e="postMessage("+f.toString()+"("+[JSON.stringify(s),u.toString(),p.toString()].join(",")+"));",r=new Blob([e],{type:"text/javascript"}),a=new Worker(URL.createObjectURL(r),{name:"wpTestEmojiSupports"});return void(a.onmessage=function(e){c(n=e.data),a.terminate(),t(n)})}catch(e){}c(n=f(s,u,p))}t(n)}).then(function(e){for(var t in e)n.supports[t]=e[t],n.supports.everything=n.supports.everything&&n.supports[t],"flag"!==t&&(n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&n.supports[t]);n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&!n.supports.flag,n.DOMReady=!1,n.readyCallback=function(){n.DOMReady=!0}}).then(function(){return e}).then(function(){var e;n.supports.everything||(n.readyCallback(),(e=n.source||{}).concatemoji?t(e.concatemoji):e.wpemoji&&e.twemoji&&(t(e.twemoji),t(e.wpemoji)))}))}((window,document),window._wpemojiSettings);

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery.min.js

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery-migrate.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/third-party.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/modernizr.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/general.min.js

jQuery(document).ready(function($){

// Check if the body has the specified class

if($('body.postid-15293').length) {

// If it does, replace the HTML content of h1.title.entry-title

$('h1.title.entry-title').html('<h1 class="title entry-title">New decision highlights options for disqualified persons: <i>Barry, in the matter of an application by Barry</i> [2024] FCA 13</h1>');

}

});

jQuery(document).ready(function( $ ){

$('.attachmentid-2444 p.attachment a').attr('href','https://www.dbalawyers.com.au/stamping_memo.pdf');

});

/* Default comment here */

jQuery(document).ready(function( $ ){

$(".page-id-3527 .post-12207 img").attr("src","/wp-content/uploads/2021/05/CPA-Logo-1400x656-2-e1621498237883.jpg");

});

jQuery(document).ready( function($){

$( '.responsiveMenuSelect' ).change(function() {

var loc = $(this).find( 'option:selected' ).val();

if( loc != '' && loc != '#' ) window.location = loc;

});

//$( '.responsiveMenuSelect' ).val('');

});

var switchTo5x=true;

Defined Benefit Pensions Update

As the 30 June 2005 defined benefit pensions (‘DBP’) deadline approaches, care must be taken in utilising the 30 June transitional relief, as its availability is quite restricted. Treasury should soon be providing its revised options in relation to the types of pensions that can be paid by small funds (funds with fewer than 50 members).

Transitional Relief

The 30 June 2005 transitional relief applies to enable a small fund to pay a DBP to a person:

- who was a member of the fund on 11 May 2004;

- who, before 1 July 2005, retires (as defined in the Superannuation Industry (Supervision) Regulations 1994 (Cth) (‘SISR’) on or after attaining age 55 or attains age 65; and

- who after 11 May 2004 and before 1 July 2005 becomes entitled to be paid a DBP where the first pension payment is made within 12 months of the person becoming entitled to the pension.

This transitional relief is somewhat problematic as:

- the requirement that a person be a member of the relevant fund on 11 May 2004 may cause difficulty in respect of reversionary beneficiaries (‘RB’) who were not members at that date; and

- the age requirement (55 years/65 years) may cause difficulty for RBs who have not attained the required age and those that have satisfied another condition of release (eg, total and permanent disablement).

Treasury Response to Industry Feedback

Treasury issued a discussion paper in January 2005, with a view to releasing a final report in late April. Following industry feedback to the changes, the report outlines a number of possible alternative strategies, including:

- developing new rules for DBPs, including changing the RBL assessment of lifetime pensions (eg, making the assessment account based and/or updating the pension valuation factors), limiting the reversionary options for pensions, and requiring payout of residual amounts. This will have the impact of removing perceived abuses in respect of RBL compression where such practices can still be undertaken (eg, by members of large funds);

- modifying existing pensions – such as market linked pensions and allocated pensions – by amending pension valuation factors to provide for greater longevity and to allow some smoothing of pension payments; and

- introducing new pensions, such as lifetime pensions and term certain pensions with annual resetting.

Documentation

Appropriate and quality documentation should be prepared to ensure compliance with the law. In particular, the following should be borne in mind:

- switching from accumulation to pension phase constitutes the issue of a new product. Therefore, a PDS must be issued. A generic PDS that covers superannuation within an SMSF would not, in our opinion, comply with the law as a comprehensive guide on the particular types of pensions available; and

- care must be taken in respect of the transitional relief in that while it enables the governing rules of a fund to be amended in order to facilitate the payment of a DBP, any such amendment may jeopardise the transitional relief provided for funds that were capable of paying DBPs on or before 11 May 2004. Please note that given its limited applicability, this other transitional relief is not discussed in this newsletter.

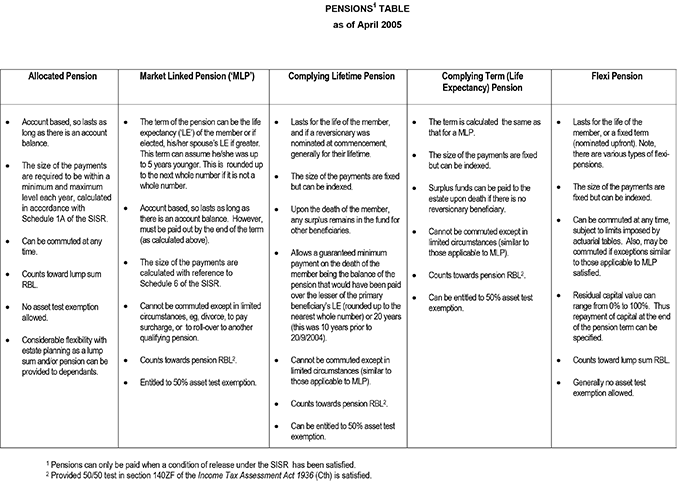

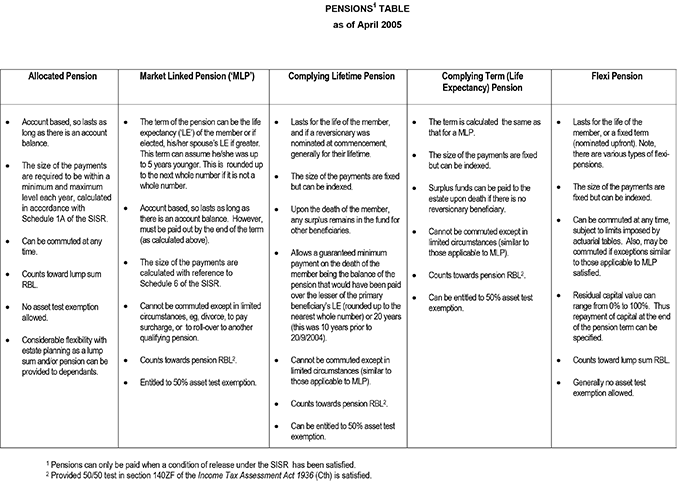

DBA Butler offers a comprehensive range of products and services in relation to all types of pensions. The next page shows a table summarising some of the main features of the various types of pensions.

For further Information please contact:

DBA LAWYERS PTY LTD (ACN 120 513 037) Level 1, 290 Coventry Street, South Melbourne Vic 3205

Ph 03 9092 9400 Fax 03 9092 9440 [email protected] www.dbalawyers.com.au

DBA News contains general information only and is no substitute for expert advice. Further, DBA is not licensed under the Corporations Act 2001 (Cth) to give financial product advice. We therefore disclaim all liability howsoever arising from reliance on any information herein unless you are a client of DBA that has specifically requested our advice.

Download as PDF

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+"://platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

console.log('Rob Info Shortcode Source:', jQuery('*[data-rob-info]').html());

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/hoverIntent.js

var uberMenuSettings = {"speed":"100","trigger":"hoverIntent","orientation":"horizontal","transition":"slide","hoverInterval":"20","hoverTimeout":"400","removeConflicts":"on","autoAlign":"off","noconflict":"off","fullWidthSubs":"off","androidClick":"off","iOScloseButton":"on","loadGoogleMaps":"off","repositionOnLoad":"off"};

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/ubermenu.min.js

https://www.dbalawyers.com.au/wp-includes/js/comment-reply.min.js

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/swv/js/index.js

var wpcf7 = {"api":{"root":"https:\/\/www.dbalawyers.com.au\/wp-json\/","namespace":"contact-form-7\/v1"},"cached":"1"};

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/js/index.js

var fsb = {"ajax":"https:\/\/www.dbalawyers.com.au\/wp-admin\/admin-ajax.php","nonce":"0db170e200"};

https://www.dbalawyers.com.au/wp-content/plugins/floating-social-bar/js/fsb.js

window.addEventListener("load", function(event) {

jQuery(".cfx_form_main,.wpcf7-form,.wpforms-form,.gform_wrapper form").each(function(){

var form=jQuery(this);

var screen_width=""; var screen_height="";

if(screen_width == ""){

if(screen){

screen_width=screen.width;

}else{

screen_width=jQuery(window).width();

} }

if(screen_height == ""){

if(screen){

screen_height=screen.height;

}else{

screen_height=jQuery(window).height();

} }

form.append('<input type="hidden" name="vx_width" value="'+screen_width+'">');

form.append('<input type="hidden" name="vx_height" value="'+screen_height+'">');

form.append('<input type="hidden" name="vx_url" value="'+window.location.href+'">');

});

});

stLight.options({publisher: "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", doNotHash: false, doNotCopy: false, hashAddressBar: false});

var options={ "publisher": "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", "position": "right", "ad": { "visible": false, "openDelay": 5, "closeDelay": 0}, "chicklets": { "items": ["facebook", "googleplus", "twitter", "linkedin", "email", "sharethis"]}};

https://www.dbalawyers.com.au/wp-content/themes/canvasChild/js/jquery.cycle2.min.js