window._wpemojiSettings = {"baseUrl":"https:\/\/s.w.org\/images\/core\/emoji\/14.0.0\/72x72\/","ext":".png","svgUrl":"https:\/\/s.w.org\/images\/core\/emoji\/14.0.0\/svg\/","svgExt":".svg","source":{"concatemoji":"https:\/\/www.dbalawyers.com.au\/wp-includes\/js\/wp-emoji-release.min.js?ver=eae3ad3c3308e88261851db62ab775ee"}};

/*! This file is auto-generated */

!function(i,n){var o,s,e;function c(e){try{var t={supportTests:e,timestamp:(new Date).valueOf()};sessionStorage.setItem(o,JSON.stringify(t))}catch(e){}}function p(e,t,n){e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(t,0,0);var t=new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data),r=(e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(n,0,0),new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data));return t.every(function(e,t){return e===r[t]})}function u(e,t,n){switch(t){case"flag":return n(e,"\ud83c\udff3\ufe0f\u200d\u26a7\ufe0f","\ud83c\udff3\ufe0f\u200b\u26a7\ufe0f")?!1:!n(e,"\ud83c\uddfa\ud83c\uddf3","\ud83c\uddfa\u200b\ud83c\uddf3")&&!n(e,"\ud83c\udff4\udb40\udc67\udb40\udc62\udb40\udc65\udb40\udc6e\udb40\udc67\udb40\udc7f","\ud83c\udff4\u200b\udb40\udc67\u200b\udb40\udc62\u200b\udb40\udc65\u200b\udb40\udc6e\u200b\udb40\udc67\u200b\udb40\udc7f");case"emoji":return!n(e,"\ud83e\udef1\ud83c\udffb\u200d\ud83e\udef2\ud83c\udfff","\ud83e\udef1\ud83c\udffb\u200b\ud83e\udef2\ud83c\udfff")}return!1}function f(e,t,n){var r="undefined"!=typeof WorkerGlobalScope&&self instanceof WorkerGlobalScope?new OffscreenCanvas(300,150):i.createElement("canvas"),a=r.getContext("2d",{willReadFrequently:!0}),o=(a.textBaseline="top",a.font="600 32px Arial",{});return e.forEach(function(e){o[e]=t(a,e,n)}),o}function t(e){var t=i.createElement("script");t.src=e,t.defer=!0,i.head.appendChild(t)}"undefined"!=typeof Promise&&(o="wpEmojiSettingsSupports",s=["flag","emoji"],n.supports={everything:!0,everythingExceptFlag:!0},e=new Promise(function(e){i.addEventListener("DOMContentLoaded",e,{once:!0})}),new Promise(function(t){var n=function(){try{var e=JSON.parse(sessionStorage.getItem(o));if("object"==typeof e&&"number"==typeof e.timestamp&&(new Date).valueOf()<e.timestamp+604800&&"object"==typeof e.supportTests)return e.supportTests}catch(e){}return null}();if(!n){if("undefined"!=typeof Worker&&"undefined"!=typeof OffscreenCanvas&&"undefined"!=typeof URL&&URL.createObjectURL&&"undefined"!=typeof Blob)try{var e="postMessage("+f.toString()+"("+[JSON.stringify(s),u.toString(),p.toString()].join(",")+"));",r=new Blob([e],{type:"text/javascript"}),a=new Worker(URL.createObjectURL(r),{name:"wpTestEmojiSupports"});return void(a.onmessage=function(e){c(n=e.data),a.terminate(),t(n)})}catch(e){}c(n=f(s,u,p))}t(n)}).then(function(e){for(var t in e)n.supports[t]=e[t],n.supports.everything=n.supports.everything&&n.supports[t],"flag"!==t&&(n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&n.supports[t]);n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&!n.supports.flag,n.DOMReady=!1,n.readyCallback=function(){n.DOMReady=!0}}).then(function(){return e}).then(function(){var e;n.supports.everything||(n.readyCallback(),(e=n.source||{}).concatemoji?t(e.concatemoji):e.wpemoji&&e.twemoji&&(t(e.twemoji),t(e.wpemoji)))}))}((window,document),window._wpemojiSettings);

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery.min.js

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery-migrate.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/third-party.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/modernizr.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/general.min.js

jQuery(document).ready(function($){

// Check if the body has the specified class

if($('body.postid-15293').length) {

// If it does, replace the HTML content of h1.title.entry-title

$('h1.title.entry-title').html('<h1 class="title entry-title">New decision highlights options for disqualified persons: <i>Barry, in the matter of an application by Barry</i> [2024] FCA 13</h1>');

}

});

jQuery(document).ready(function( $ ){

$('.attachmentid-2444 p.attachment a').attr('href','https://www.dbalawyers.com.au/stamping_memo.pdf');

});

/* Default comment here */

jQuery(document).ready(function( $ ){

$(".page-id-3527 .post-12207 img").attr("src","/wp-content/uploads/2021/05/CPA-Logo-1400x656-2-e1621498237883.jpg");

});

jQuery(document).ready( function($){

$( '.responsiveMenuSelect' ).change(function() {

var loc = $(this).find( 'option:selected' ).val();

if( loc != '' && loc != '#' ) window.location = loc;

});

//$( '.responsiveMenuSelect' ).val('');

});

var switchTo5x=true;

SMSFs & Unit Trusts: Planning tips & traps

SMSFs often invest in unit trusts and should do so with great care as there are a number of tips and traps; even for experienced advisers.

If an SMSF now invests in a related unit trust after 30 June 2009, such an investment will be an in-house asset. Therefore, the overall value of in-house assets should be closely monitored to ensure the 5% level is not exceeded. Furthermore, if the unit trust is a related party, this would also be prohibited if the 5% limit was exceeded under s66 of the Superannuation Industry (Supervision) Act 1993 (Cth) (‘SISA’).

However, if an SMSF invests in a non-geared unit trust (even a related non-geared unit trust) that satisfies the exception to the in-house asset test in Div 13.3A of the Superannuation Industry (Supervision) Regulations 1994 (Cth) (‘SISR’), then this could be a permitted investment if the relevant rules in Div 13.3A are satisfied.

Where a unit trust qualifies as a non-geared unit trust then its activities are generally restricted to investing in real estate property. For instance, such a unit trust cannot own an interest in another entity (eg, having a cash management trust account is precluded).

One of the issues that is obtaining more attention these days is the fact that the term unit trust is not an exact science. For instance, there is no standard unit trust deed. This has resulted in there being wide spread differences in the quality between one unit trust deed and another. In particular, certain unit trusts may qualify as a fixed trust for tax purposes.

There are a number of advantages in qualifying as a fixed trust for tax purposes. These include less stringent tests applying for the carry forward of losses and for the ability to pass on the benefits of any franking credits.

Distributions from a unit trust that qualifies as a fixed trust should also obtain concessional tax treatment on receipt by a superannuation fund. Distributions from non-fixed interests (eg, discretionary units) are taxed at 45% (non-arm’s length income).

There may also be land tax advantages as certain jurisdictions impose special land tax rates unless the trust is a fixed trust.

Finally, it is worth noting that a unit trust may be taxed as a company in certain cases. Broadly, this can arise where the unit trust receives more than 25% of its income from non-real estate rental activities and superannuation funds overall hold more than a 20% stake in the unit trust.

Thus, there are different meanings and definitions of a fixed trust including:

- for tax purposes;

- for land tax purposes; and

- for trust law purposes.

As there are various tests of what is a fixed trust you should therefore ensure the unit trust deed that is used is appropriate for its intended purpose. In fact, DBA has come across numerous suppliers that claim their deeds are fixed when in fact they have discretionary entitlements or interests that can be removed by a majority of members. Expert advice should therefore be obtained if there is any doubt as any subsequent change can result in extra costs.

Note that, in addition to DBA offering a fixed unit trust for tax purposes, we also offer an SMSF & Unit Trust Kit which provides valuable guidance and practical tools for SMSFs that invest in unit trusts – see below.

Anti-detriment deductions

The ATO has released two important interpretative decisions on anti-detriment deductions.

Background: how anti-detriment deductions work

Prior to 1 July 1988, contributions to super funds were not subject to income tax. From 1 July 1988, deductible contributions to funds became subject to 15% tax. When this change was introduced the then Treasurer, Paul Keating, said that the government did not want to ‘tax the dead’. Accordingly, a mechanism was introduced to ensure that no detriment would be suffered by spouses and children of a deceased. That mechanism is the ‘anti-detriment deduction’.

Upon a member’s death, the anti-detriment deduction encourages funds to ‘top up’ the deceased’s payout. Specifically, the legislation provides that the fund can claim a deduction (which results in a tax saving that can finance the top up payment) if it implements the following steps:

- Upon a member’s death the fund pays out a lump sum to a spouse or child of the deceased.

- The fund increases that lump sum by an amount so that the lump sum is the same amount it would have been if no tax on contributions were payable.

A fund can then claim a deduction calculated as the amount of the increase divided by 15%.

This is best explained with a simple example.

Dad’s employer contributes $20,000 to a super fund on behalf of Dad. Dad then dies. If there was no tax on contributions, the fund would have $20,000 to pay to Dad’s spouse or children. However, as the $20,000 is subject to 15% tax the death payout is only $17,000 (ie, $20,000 less $20,000 x 15%). The detriment that his spouse or children would suffer is the difference between:

- what they would have received if contributions had never been made subject to tax; and

- what is sitting in Dad’s member account in the fund upon his death.

Accordingly, in this scenario, the detriment that Dad’s spouse or children would suffer because of the tax on contributions is $3,000 (ie, $20,000 less $17,000).

Therefore, if the fund tops up any lump sum payment to Dad’s spouse or children by $3,000 so they receive $20,000, the fund can claim a deduction of $20,000 (ie, $3,000 divided by 15%). As you will appreciate, this can result in significant tax deductions to a fund and in many cases results in a carry forward loss.

ATO ID 2010/1: adult children eligible

Some have queried whether an anti-detriment deduction is available if the lump sum is paid to an adult independent child. DBA’s view has always been that a deduction is available in these circumstances. ATO ID 2010/1 confirms this view.

ATO ID 2010/5: how to calculate the increase

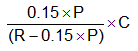

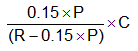

The ATO had previously indicated that it would allow the following formula to be used to calculate the increase but only where the actual amount cannot be calculated by the fund:

In ATO ID 2010/5, the ATO indicate they will still accept this formula even if the actual amount can be calculated but the fund’s records did not track the effect of fund tax on the accounts of individual members.

Many SMSFs do not track the amount of tax on contributions and consideration should be given to doing so as the facts in ATO ID 2010/5 involved a ‘large’ super fund.

For further Information please contact:

DBA LAWYERS PTY LTD (ACN 120 513 037) Level 1, 290 Coventry Street, South Melbourne Vic 3205

Ph 03 9092 9400 Fax 03 9092 9440 [email protected] www.dbalawyers.com.au

DBA News contains general information only and is no substitute for expert advice. Further, DBA is not licensed under the Corporations Act 2001 (Cth) to give financial product advice. We therefore disclaim all liability howsoever arising from reliance on any information herein unless you are a client of DBA that has specifically requested our advice.

Download as PDF

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+"://platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

console.log('Rob Info Shortcode Source:', jQuery('*[data-rob-info]').html());

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/hoverIntent.js

var uberMenuSettings = {"speed":"100","trigger":"hoverIntent","orientation":"horizontal","transition":"slide","hoverInterval":"20","hoverTimeout":"400","removeConflicts":"on","autoAlign":"off","noconflict":"off","fullWidthSubs":"off","androidClick":"off","iOScloseButton":"on","loadGoogleMaps":"off","repositionOnLoad":"off"};

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/ubermenu.min.js

https://www.dbalawyers.com.au/wp-includes/js/comment-reply.min.js

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/swv/js/index.js

var wpcf7 = {"api":{"root":"https:\/\/www.dbalawyers.com.au\/wp-json\/","namespace":"contact-form-7\/v1"},"cached":"1"};

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/js/index.js

var fsb = {"ajax":"https:\/\/www.dbalawyers.com.au\/wp-admin\/admin-ajax.php","nonce":"ec8b0134a4"};

https://www.dbalawyers.com.au/wp-content/plugins/floating-social-bar/js/fsb.js

window.addEventListener("load", function(event) {

jQuery(".cfx_form_main,.wpcf7-form,.wpforms-form,.gform_wrapper form").each(function(){

var form=jQuery(this);

var screen_width=""; var screen_height="";

if(screen_width == ""){

if(screen){

screen_width=screen.width;

}else{

screen_width=jQuery(window).width();

} }

if(screen_height == ""){

if(screen){

screen_height=screen.height;

}else{

screen_height=jQuery(window).height();

} }

form.append('<input type="hidden" name="vx_width" value="'+screen_width+'">');

form.append('<input type="hidden" name="vx_height" value="'+screen_height+'">');

form.append('<input type="hidden" name="vx_url" value="'+window.location.href+'">');

});

});

stLight.options({publisher: "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", doNotHash: false, doNotCopy: false, hashAddressBar: false});

var options={ "publisher": "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", "position": "right", "ad": { "visible": false, "openDelay": 5, "closeDelay": 0}, "chicklets": { "items": ["facebook", "googleplus", "twitter", "linkedin", "email", "sharethis"]}};

https://www.dbalawyers.com.au/wp-content/themes/canvasChild/js/jquery.cycle2.min.js