The vacant residential land tax (VRLT) applies to all vacant residential land throughout Victoria from 1 January 2025. This tax can also apply to holiday homes unless the holiday home exemption (HH Exemption) or another exemption applies.

What is VRLT?

VRLT was originally introduced in 2017 to assist with housing affordability as overseas purchasers were buying homes in the inner and middle suburban areas of Melbourne. From 1 January 2025, the VRLT applies to all vacant residential land in Victoria.

VRLT is an annual tax that is based on 1% of the capital improved value (CIV) of vacant residential land in the first year, in addition to any general land tax, eg, a vacant home valued at $1 million will incur $10,000 VRLT in the first year in addition to any land tax.

An exemption may apply where residential land is used and occupied as a holiday home for at least 4 weeks of the year. However, certain criteria needs to be satisfied each year before the HH Exemption applies.

For more general information on VRLT, please refer to our prior article here.

The holiday home exemption

Residential land is subject to the VRLT where it has been vacant for more than 6 months. However, an exemption applies where the owner or a relative used and occupied the land as a holiday home for at least 4 weeks of the preceding year. For this exemption to apply, the owner must have used and occupied other land in Australia as a principal place of residence (PPR).

A ‘relative’ within the meaning of the Land Tax Act 2005 (Vic) is rather narrowly defined and covers, among others, the spouse of the owner, as well as a sibling or child of either the owner or a spouse of a sibling and child.

The Commissioner also needs to be satisfied that the land is used as a holiday home. In doing so, he considers the location of the land, the distance between the owner’s PPR and their holiday home as well as the nature and frequency of any use of the land.

If the HH Exemption criteria are satisfied and the Commissioner is satisfied, the holiday home should not be subject to the VRLT.

Misconceptions

Not everyone owns their holiday home personally. Many people, for instance, have chosen to hold land in a family trust or family company for asset protection or for other reasons. Understandably, those people would want to benefit from the HH Exemption to avoid paying VRLT. However, the HH Exemption is only available to those who own their holiday home in their personal name, and not where the land is held via a trust or a company.

Can holiday homes owned via a trust or company satisfy an exemption?

Since the HH Exemption relies on an individual owner who has a PPR, residential property that is owned by a trustee of a trust or a company needs to be able to establish more than 6 months of use and occupation by a natural person with a lease or short term letting arrangement so the land is not subject to VRLT.

For many holiday homes, seeking to ‘clock up’ greater than 6 months use and occupation (6+ Month Test) may prove challenging, if not impossible.

One possibility is for the trustee or company to lease the land on a long-term lease to one or more natural persons and retain records of the use and occupation of the property to determine whether an exemption will apply in the following year.

This would likely require an arm’s length lease as the Commissioner needs to be satisfied that the lease was made in good faith and is not for the purpose of avoiding VRLT. For example, the Commissioner may argue that a lease with less than market value rent, or one that is in place for just over 6 months each year, is designed to avoid VRLT.

A lease that involves a related person should be on arm’s length terms, ie, similar terms that would be expected to be entered into between arm’s length parties. If the lease is with an unrelated third party, the lease would generally be at arm’s length unless it did not reflect arm’s length terms.

Naturally, any lease should comply with landlord and tenant law including the provision of condition report, security deposit, regular rent payments, etc. Unfortunately, if the property cannot be leased and remains vacant, the VRLT still applies as there appears to be no discretion to exempt a property even if it can never be leased.

There is a limited exemption for certain trusts

The HH Exemption may apply to a vested beneficiary of a trust but this is not common. A vested beneficiary is a natural person who has a vested beneficial interest in possession in the land or is the principal beneficiary of a special disability trust.

Most trusts holding holiday homes are likely to be discretionary or family trusts and typically these have no property vested in a particular beneficiary. Also, while there may be the prospect of vesting a property in a natural person beneficiary, this requires careful analysis especially of the income tax (including capital gains tax, CGT) and duty implications. Typically, CGT and duty apply on a transfer or vesting of property in the name of a natural person by the trustee of a discretionary trust.

What other issues arise if an arm’s length lease is implemented?

If an arm’s length lease is put in place, then:

- Regular arm’s length rental payments should be paid to the landlord (owner).

- If the owner is charging arm’s length rent for the land, then the usual expenses related to residential rental properties become tax deductible, eg, land tax, rates, services, VRLT and repairs and maintenance.

- The rental income will be assessable income and (after deductions etc) income tax will be payable thereon. A trust typically distributes its net income to its beneficiaries who pay the income tax.

If the rent charged is less than arm’s length rent, the expenses would only be deductible to the extent the property is used to derive assessable income. This has been an ongoing issue with holiday homes as the ATO closely scrutinise rental property deductions, especially holiday homes, in this regard. Moreover, the Commissioner has to be satisfied that the lease is not for the purpose of avoiding VRLT. Thus, an arm’s length lease should minimise these risks. Naturally, appropriate tax advice should also be obtained to ensure compliance with tax legislation.

However, as noted above, even if a lease is implemented where a holiday home is owned via a trust or company, the 6+ Month Test must still be satisfied, ie, there is use and occupation by the natural person tenant(s) of the holiday home in the prior year of greater than 6 months.

It is also important to note that the VRLT applies to all vacant residential land in Victoria from 1 January 2025 but it is the use and occupation of the land from 1 January 2024 that counts in relation to the 2025 assessment.

An increased tax rate applies for subsequent vacant years

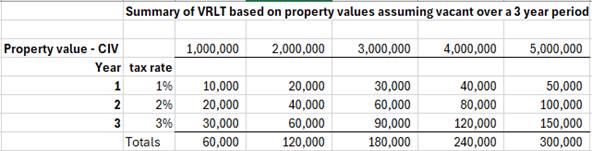

Where the land remains vacant after the first year, the amount of tax increases in subsequent years. If the land remains vacant for 2 consecutive years, then the VRLT rate increases to 2%. If the land remains vacant for 3 or more consecutive years, then then rate increases to 3%. The example below outlines how this new tax can quickly triple in value unless an exemption can be obtained.

Example of how VRLT applies

Joe and Mary Salmon own a holiday home in regional Victoria via their family trust and their PPR is in Melbourne. Joe and Mary have four children, two adults and two under 18 years.

The holiday home is currently valued at $1 million.

As the home is owned by a trustee of a family trust, the HH Exemption does not apply.

Thus, the exemption outlined above (namely, where an arm’s length lease is implemented and the 6+ Month Test is satisfied), is one method of not paying VRLT.

However, if the tenant (to the lease) cannot satisfy the 6+ Month Test in the prior year (2024), then VRLT of $10,000 will apply in January 2025 (ie, 1% x $1 million).

In year 2, if the tenant (to the lease) cannot satisfy the 6+ Month Test in the prior year (2025), then VRLT of $20,000 will apply in January 2026 (ie, 2% x $1 million – assuming there is no change to the value of the land).

In year 3, if the tenant (to the lease) cannot satisfy the 6+ Month Test in the prior year (2026), then VRLT of $30,000 will apply in January 2027 (ie, 3% x $1 million – assuming there is no change to the value of the land).

The table below summarises the cost of VRLT depending on the value of the land over a 3 year period, assuming the land remains vacant for each year.

As you can see, the cost of holding a holiday home in a trust or company may quickly become prohibitive.

Possible legislative change

The Victorian Government said it would extend the HH Exemption to holiday homes owned by trusts and companies; at least to holiday homes acquired by trusts and companies prior to the date of the announced changes in October 2023. However, until such a change of law occurs, the prudent course would be to obtain advice on what is the best option to pursue as a change may not happen.

Impact on SMSFs

Since an SMSFs is a type of trust, the land will not qualify for the HH Exemption. Therefore, the SMSF trustee would need to satisfy the 6+ Month Test to avoid VRLT. As discussed above, this would likely involve putting an arm’s length lease in place in relation to the land.

It is important to note that SMSF trustees should not lease residential land to related parties as there is a prohibition on doing so in the Superannuation Industry (Supervision) Act 1993 (Cth).

Conclusion

Many are not aware of the impact and substantial cost of the recent changes and may run out of time to plan ahead to minimise the new tax. We recommend that timely advice be obtained in respect of your particular circumstances to determine your options. Naturally, DBA Lawyers would be pleased to assist.

Related articles:

- Vacant Residential Land Tax in Victoria soon to be extended

- Vacant residential land tax — Q&A from recent DBA webinar

- DBA Lawyers Tax Services

- Related Tax & Business Services

- Discretionary trusts & the foreign purchaser duty surcharge across Australia

* * *

This article is for general information only and should not be relied upon without first seeking advice from an appropriately qualified professional. The above does not constitute financial product advice. Financial product advice can only be obtained from a licenced financial adviser under the Corporations Act 2001 (Cth).

Note: DBA Lawyers presents monthly online SMSF training. For more details or to register, visit www.dbanetwork.com.au or call 03 9092 9400.

For more information regarding how DBA Lawyers can assist in your SMSF practice, visit www.dbalawyers.com.au.

By Daniel Butler, Director ([email protected]) and Nick Walker, Lawyer ([email protected]).

DBA LAWYERS

18 April 2024