window._wpemojiSettings = {"baseUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/72x72\/","ext":".png","svgUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/svg\/","svgExt":".svg","source":{"concatemoji":"https:\/\/www.dbalawyers.com.au\/wp-includes\/js\/wp-emoji-release.min.js?ver=27fe84cc702a2d02d851b8f2a8bba567"}};

/*! This file is auto-generated */

!function(i,n){var o,s,e;function c(e){try{var t={supportTests:e,timestamp:(new Date).valueOf()};sessionStorage.setItem(o,JSON.stringify(t))}catch(e){}}function p(e,t,n){e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(t,0,0);var t=new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data),r=(e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(n,0,0),new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data));return t.every(function(e,t){return e===r[t]})}function u(e,t,n){switch(t){case"flag":return n(e,"\ud83c\udff3\ufe0f\u200d\u26a7\ufe0f","\ud83c\udff3\ufe0f\u200b\u26a7\ufe0f")?!1:!n(e,"\ud83c\uddfa\ud83c\uddf3","\ud83c\uddfa\u200b\ud83c\uddf3")&&!n(e,"\ud83c\udff4\udb40\udc67\udb40\udc62\udb40\udc65\udb40\udc6e\udb40\udc67\udb40\udc7f","\ud83c\udff4\u200b\udb40\udc67\u200b\udb40\udc62\u200b\udb40\udc65\u200b\udb40\udc6e\u200b\udb40\udc67\u200b\udb40\udc7f");case"emoji":return!n(e,"\ud83d\udc26\u200d\u2b1b","\ud83d\udc26\u200b\u2b1b")}return!1}function f(e,t,n){var r="undefined"!=typeof WorkerGlobalScope&&self instanceof WorkerGlobalScope?new OffscreenCanvas(300,150):i.createElement("canvas"),a=r.getContext("2d",{willReadFrequently:!0}),o=(a.textBaseline="top",a.font="600 32px Arial",{});return e.forEach(function(e){o[e]=t(a,e,n)}),o}function t(e){var t=i.createElement("script");t.src=e,t.defer=!0,i.head.appendChild(t)}"undefined"!=typeof Promise&&(o="wpEmojiSettingsSupports",s=["flag","emoji"],n.supports={everything:!0,everythingExceptFlag:!0},e=new Promise(function(e){i.addEventListener("DOMContentLoaded",e,{once:!0})}),new Promise(function(t){var n=function(){try{var e=JSON.parse(sessionStorage.getItem(o));if("object"==typeof e&&"number"==typeof e.timestamp&&(new Date).valueOf()<e.timestamp+604800&&"object"==typeof e.supportTests)return e.supportTests}catch(e){}return null}();if(!n){if("undefined"!=typeof Worker&&"undefined"!=typeof OffscreenCanvas&&"undefined"!=typeof URL&&URL.createObjectURL&&"undefined"!=typeof Blob)try{var e="postMessage("+f.toString()+"("+[JSON.stringify(s),u.toString(),p.toString()].join(",")+"));",r=new Blob([e],{type:"text/javascript"}),a=new Worker(URL.createObjectURL(r),{name:"wpTestEmojiSupports"});return void(a.onmessage=function(e){c(n=e.data),a.terminate(),t(n)})}catch(e){}c(n=f(s,u,p))}t(n)}).then(function(e){for(var t in e)n.supports[t]=e[t],n.supports.everything=n.supports.everything&&n.supports[t],"flag"!==t&&(n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&n.supports[t]);n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&!n.supports.flag,n.DOMReady=!1,n.readyCallback=function(){n.DOMReady=!0}}).then(function(){return e}).then(function(){var e;n.supports.everything||(n.readyCallback(),(e=n.source||{}).concatemoji?t(e.concatemoji):e.wpemoji&&e.twemoji&&(t(e.twemoji),t(e.wpemoji)))}))}((window,document),window._wpemojiSettings);

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery.min.js

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery-migrate.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/third-party.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/modernizr.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/general.min.js

jQuery(document).ready(function($){

// Check if the body has the specified class

if($('body.postid-15293').length) {

// If it does, replace the HTML content of h1.title.entry-title

$('h1.title.entry-title').html('<h1 class="title entry-title">New decision highlights options for disqualified persons: <i>Barry, in the matter of an application by Barry</i> [2024] FCA 13</h1>');

}

});

jQuery(document).ready(function( $ ){

$('.attachmentid-2444 p.attachment a').attr('href','https://www.dbalawyers.com.au/stamping_memo.pdf');

});

/* Default comment here */

jQuery(document).ready(function( $ ){

$(".page-id-3527 .post-12207 img").attr("src","/wp-content/uploads/2021/05/CPA-Logo-1400x656-2-e1621498237883.jpg");

});

jQuery(document).ready( function($){

$( '.responsiveMenuSelect' ).change(function() {

var loc = $(this).find( 'option:selected' ).val();

if( loc != '' && loc != '#' ) window.location = loc;

});

//$( '.responsiveMenuSelect' ).val('');

});

var switchTo5x=true;

New Pension Regulations Finalised

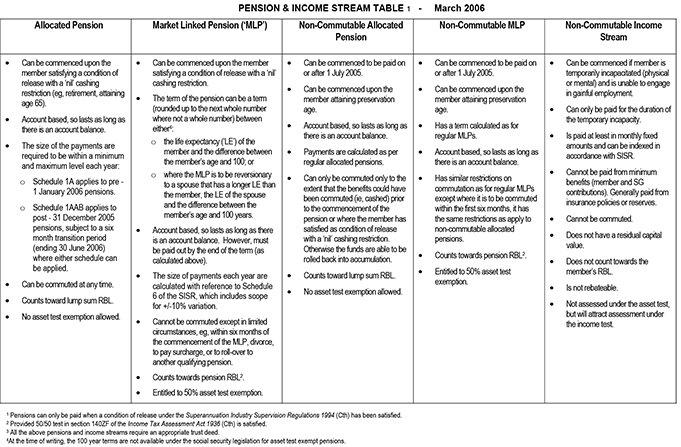

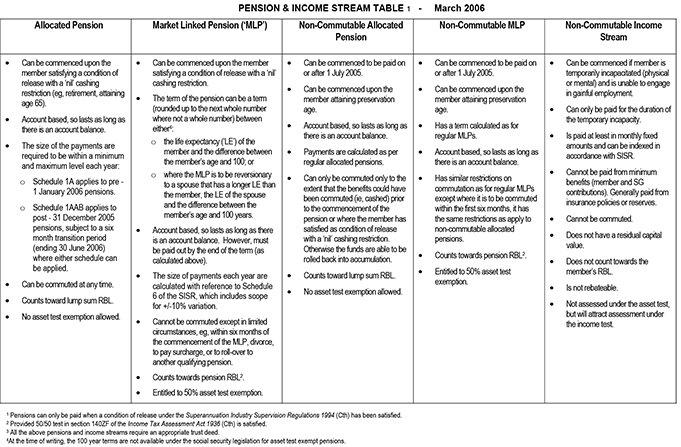

The revised regulations that affect the payment of allocated pensions (‘AP’) and market linked pensions (‘MLP’) were finalised in mid December 2005 with a number significant changes. This edition of news highlights the main changes and includes a table of pensions and income streams payable from an SMSF.

Allocated Pension Changes

New pension valuation factors (Schedule 1AAB of SISR) have been introduced that more accurately reflect current life expectancy tables. The new factors apply to APs starting on or after 1 January 2006, while the old factors (Schedule 1A of SISR) continue to apply to APs commenced prior to 1 January 2006. Where a pension commences on or after 1 January 2006 there is also a six month transition period during which a member can choose to use either the old factors (1A) or the new factors (1AAB) for the period from 1 January to 30 June 2006. However payments made in later financial years must use the new factors (1AAB).

The previously proposed factors in relation to reversionary child beneficiaries have been removed from the final regulations (these were designed to require a reversionary AP to a child to be paid out by age 25).

Market Linked Pension Changes

Broadly, an MLP that commences on or after 1 January 2006 may be paid over one of the following terms:

- the life expectancy (‘LE’) of the pensioner (or their LE assuming they were up to five years younger);

- if the MLP reverts to the pensioner’s spouse, their spouse’s LE (if greater than the pensioner’s) or their spouse’s LE assuming they were up to five years younger; or

- a term that is greater than the above terms, that will be paid up to the pensioner’s (or the pensioner’s spouse’s) 100th birthday (if the spouse is a reversionary pensioner and younger than the pensioner).

Market Linked Pension Income Payments

For all MLPs (not just those commencing on or after 1 January 2006), there is now greater flexibility for determining annual pension payments. From 1 January 2006, the pension payable for a particular year may be calculated as: [account balance at 1 July] ÷ [relevant pension factor] ± ≤10%.

Account Balance

The account balance is to be used for determining the annual pension payment of an AP or MLP. The draft regulations included ‘fund reserves attributable to the pension benefit’, but this has been now abolished.

Documentation

Now more than ever, you must ensure your SMSF deed and pension documents are up to date.

For further Information please contact:

DBA LAWYERS PTY LTD (ACN 120 513 037) Level 1, 290 Coventry Street, South Melbourne Vic 3205

Ph 03 9092 9400 Fax 03 9092 9440 [email protected] www.dbalawyers.com.au

DBA News contains general information only and is no substitute for expert advice. Further, DBA is not licensed under the Corporations Act 2001 (Cth) to give financial product advice. We therefore disclaim all liability howsoever arising from reliance on any information herein unless you are a client of DBA that has specifically requested our advice.

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+"://platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

console.log('Rob Info Shortcode Source:', jQuery('*[data-rob-info]').html());

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/hoverIntent.js

var uberMenuSettings = {"speed":"100","trigger":"hoverIntent","orientation":"horizontal","transition":"slide","hoverInterval":"20","hoverTimeout":"400","removeConflicts":"on","autoAlign":"off","noconflict":"off","fullWidthSubs":"off","androidClick":"off","iOScloseButton":"on","loadGoogleMaps":"off","repositionOnLoad":"off"};

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/ubermenu.min.js

https://www.dbalawyers.com.au/wp-includes/js/comment-reply.min.js

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/swv/js/index.js

var wpcf7 = {"api":{"root":"https:\/\/www.dbalawyers.com.au\/wp-json\/","namespace":"contact-form-7\/v1"},"cached":"1"};

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/js/index.js

var fsb = {"ajax":"https:\/\/www.dbalawyers.com.au\/wp-admin\/admin-ajax.php","nonce":"6ad6b1dd80"};

https://www.dbalawyers.com.au/wp-content/plugins/floating-social-bar/js/fsb.js

window.addEventListener("load", function(event) {

jQuery(".cfx_form_main,.wpcf7-form,.wpforms-form,.gform_wrapper form").each(function(){

var form=jQuery(this);

var screen_width=""; var screen_height="";

if(screen_width == ""){

if(screen){

screen_width=screen.width;

}else{

screen_width=jQuery(window).width();

} }

if(screen_height == ""){

if(screen){

screen_height=screen.height;

}else{

screen_height=jQuery(window).height();

} }

form.append('<input type="hidden" name="vx_width" value="'+screen_width+'">');

form.append('<input type="hidden" name="vx_height" value="'+screen_height+'">');

form.append('<input type="hidden" name="vx_url" value="'+window.location.href+'">');

});

});

stLight.options({publisher: "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", doNotHash: false, doNotCopy: false, hashAddressBar: false});

var options={ "publisher": "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", "position": "right", "ad": { "visible": false, "openDelay": 5, "closeDelay": 0}, "chicklets": { "items": ["facebook", "googleplus", "twitter", "linkedin", "email", "sharethis"]}};

https://www.dbalawyers.com.au/wp-content/themes/canvasChild/js/jquery.cycle2.min.js