window._wpemojiSettings = {"baseUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/72x72\/","ext":".png","svgUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/svg\/","svgExt":".svg","source":{"concatemoji":"https:\/\/www.dbalawyers.com.au\/wp-includes\/js\/wp-emoji-release.min.js?ver=27fe84cc702a2d02d851b8f2a8bba567"}};

/*! This file is auto-generated */

!function(i,n){var o,s,e;function c(e){try{var t={supportTests:e,timestamp:(new Date).valueOf()};sessionStorage.setItem(o,JSON.stringify(t))}catch(e){}}function p(e,t,n){e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(t,0,0);var t=new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data),r=(e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(n,0,0),new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data));return t.every(function(e,t){return e===r[t]})}function u(e,t,n){switch(t){case"flag":return n(e,"\ud83c\udff3\ufe0f\u200d\u26a7\ufe0f","\ud83c\udff3\ufe0f\u200b\u26a7\ufe0f")?!1:!n(e,"\ud83c\uddfa\ud83c\uddf3","\ud83c\uddfa\u200b\ud83c\uddf3")&&!n(e,"\ud83c\udff4\udb40\udc67\udb40\udc62\udb40\udc65\udb40\udc6e\udb40\udc67\udb40\udc7f","\ud83c\udff4\u200b\udb40\udc67\u200b\udb40\udc62\u200b\udb40\udc65\u200b\udb40\udc6e\u200b\udb40\udc67\u200b\udb40\udc7f");case"emoji":return!n(e,"\ud83d\udc26\u200d\u2b1b","\ud83d\udc26\u200b\u2b1b")}return!1}function f(e,t,n){var r="undefined"!=typeof WorkerGlobalScope&&self instanceof WorkerGlobalScope?new OffscreenCanvas(300,150):i.createElement("canvas"),a=r.getContext("2d",{willReadFrequently:!0}),o=(a.textBaseline="top",a.font="600 32px Arial",{});return e.forEach(function(e){o[e]=t(a,e,n)}),o}function t(e){var t=i.createElement("script");t.src=e,t.defer=!0,i.head.appendChild(t)}"undefined"!=typeof Promise&&(o="wpEmojiSettingsSupports",s=["flag","emoji"],n.supports={everything:!0,everythingExceptFlag:!0},e=new Promise(function(e){i.addEventListener("DOMContentLoaded",e,{once:!0})}),new Promise(function(t){var n=function(){try{var e=JSON.parse(sessionStorage.getItem(o));if("object"==typeof e&&"number"==typeof e.timestamp&&(new Date).valueOf()<e.timestamp+604800&&"object"==typeof e.supportTests)return e.supportTests}catch(e){}return null}();if(!n){if("undefined"!=typeof Worker&&"undefined"!=typeof OffscreenCanvas&&"undefined"!=typeof URL&&URL.createObjectURL&&"undefined"!=typeof Blob)try{var e="postMessage("+f.toString()+"("+[JSON.stringify(s),u.toString(),p.toString()].join(",")+"));",r=new Blob([e],{type:"text/javascript"}),a=new Worker(URL.createObjectURL(r),{name:"wpTestEmojiSupports"});return void(a.onmessage=function(e){c(n=e.data),a.terminate(),t(n)})}catch(e){}c(n=f(s,u,p))}t(n)}).then(function(e){for(var t in e)n.supports[t]=e[t],n.supports.everything=n.supports.everything&&n.supports[t],"flag"!==t&&(n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&n.supports[t]);n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&!n.supports.flag,n.DOMReady=!1,n.readyCallback=function(){n.DOMReady=!0}}).then(function(){return e}).then(function(){var e;n.supports.everything||(n.readyCallback(),(e=n.source||{}).concatemoji?t(e.concatemoji):e.wpemoji&&e.twemoji&&(t(e.twemoji),t(e.wpemoji)))}))}((window,document),window._wpemojiSettings);

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery.min.js

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery-migrate.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/third-party.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/modernizr.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/general.min.js

jQuery(document).ready(function($){

// Check if the body has the specified class

if($('body.postid-15293').length) {

// If it does, replace the HTML content of h1.title.entry-title

$('h1.title.entry-title').html('<h1 class="title entry-title">New decision highlights options for disqualified persons: <i>Barry, in the matter of an application by Barry</i> [2024] FCA 13</h1>');

}

});

jQuery(document).ready(function( $ ){

$('.attachmentid-2444 p.attachment a').attr('href','https://www.dbalawyers.com.au/stamping_memo.pdf');

});

/* Default comment here */

jQuery(document).ready(function( $ ){

$(".page-id-3527 .post-12207 img").attr("src","/wp-content/uploads/2021/05/CPA-Logo-1400x656-2-e1621498237883.jpg");

});

jQuery(document).ready( function($){

$( '.responsiveMenuSelect' ).change(function() {

var loc = $(this).find( 'option:selected' ).val();

if( loc != '' && loc != '#' ) window.location = loc;

});

//$( '.responsiveMenuSelect' ).val('');

});

var switchTo5x=true;

Choice, default and stapled funds — what’s this all about?

Overview

Choice of fund forms were introduced from 1 July 2005 to allow employees to choose which superannuation fund would receive their superannuation guarantee contributions (SG contributions). This was aimed at enabling employees to select the fund of their ‘choice’.

Since mid-2005, there have been numerous developments impacting the choice of fund regime including default and stapled funds. However, these terms are not that well understood in practice and this article provides a brief overview from an employer and employee perspective in light of recent changes.

How do ‘default funds’ impact choice of fund?

If the choice of fund form is not completed and the employee does not have a stapled fund, then the employer must pay SG contributions to the employer’s default fund. Generally, employers have the flexibility to choose a default fund for their employees if the relevant award or enterprise agreement does not dictate which default fund to use.

When deciding on a default fund, the employer must choose a fund that offers a MySuper product.

How do ‘stapled funds’ impact choice of fund?

Employers need to request the stapled fund from the ATO for all new employees if:

- the employer needs to make SG contributions for that employee; and

- the employee is eligible to choose a super fund but has not.

A stapled fund is an existing superannuation fund that is linked, or ‘stapled’, to an individual employee. This superannuation fund will, broadly ‘follow’ the employee if they change jobs.

The employer may still need to request a stapled super fund for some employees who are not eligible to choose their own super fund. This includes employees that are either:

- temporary residents; or

- covered by an enterprise agreement or workplace determination made before 1 January 2021.

One of the main reasons behind the introduction of the stapled fund system was to reduce the amount of unnecessary superannuation fund accounts. It is not uncommon for a new employee to have their SG contributions paid into the employer’s default fund, rather than an existing superannuation fund account. This created a problem for those who changed jobs regularly and ended up with multiple fund accounts. This meant that the individual was paying multiple sets of administrative fees and, in some cases, insurance premiums.

Do employers still need to provide a choice of fund form for new employees?

While the ATO’s choice of fund form is still an option for employers/employees, it is no longer the only option. An employer may choose to use their own software to capture an employee’s choice of superannuation fund. This software must still capture all the mandatory fields that the ATO’s choice of fund form requires, although it may streamline this process.

MyGov now allows new employees to provide TFN and super details to employers

What once required physical paperwork can now be done online. Provided the employee has kept their MyGov account details up to date, an employee can download a pre-populated choice of fund form that they can complete and give to their employer their tax file number (TFN) and choice of fund.

Employer perspective after they hire a new employee

There are several steps that an employer must take before paying SG contributions for a new employee, including giving the employee a choice of fund form or requesting they supply their TFN and choice of fund details via the employee’s MyGov account.

If the employee does not provide a choice of fund to their employer, the employer is required to request a stapled fund from the ATO.

However, if the employee has not made a choice of fund and does not have a stapled fund (or any other fund linked to their MyGov account), the employer can pay SG contributions into the default fund. However, if an employee later notifies their employer of their choice of fund, then the employer has two months to start paying SG contributions to the employee’s ‘chosen’ fund.

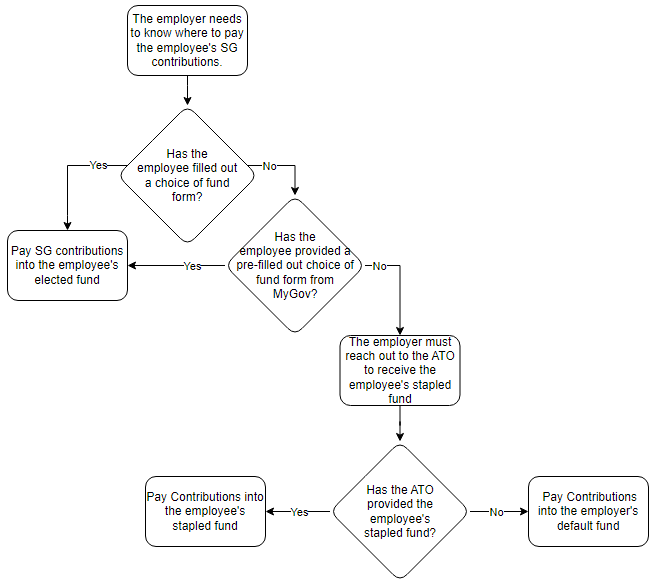

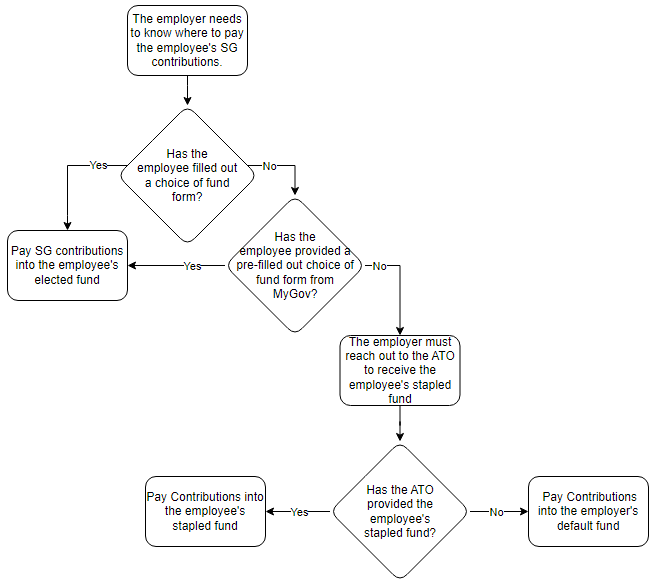

A flow chart diagram provides a simplified summary of this process.

Penalties

There are multiple penalties that can apply to an employer where they fail to satisfy their superannuation obligations. Penalties can apply for, among other things, not complying with the choice of fund criteria, the SG regime and potential adverse HR consequences.

Conclusions

There have been considerable developments introduced following the introduction of the humble choice of fund form in mid-2005. Not all employers and employees have caught up with these changes especially given they have not been well publicised.

Naturally, advisers should ensure that their clients which are likely to include both employers and employees are on top of all these changes and are getting any efficiencies that might be available from the recent changes, especially the range of online options now available.

DBA Lawyers would be pleased to assist if you have any queries.

Related articles

* * *

This article is for general information only and should not be relied upon without first seeking advice from an appropriately qualified professional. The above does not constitute financial product advice. Financial product advice can only be obtained from a licenced financial adviser under the Corporations Act 2001 (Cth).

Note: DBA Lawyers presents monthly online SMSF training. For more details or to register, visit www.dbanetwork.com.au.

For more information regarding how DBA Lawyers can assist in your SMSF practice, visit www.dbalawyers.com.au.

By Daniel Butler ([email protected]) Director and Nick Walker ([email protected]) Lawyer, DBA Lawyers.

DBA LAWYERS

13 October 2023

ANNEXURE

Flow Chart

Below is a flow chart the depicts what an employer must do when working out where to pay an employee’s SG contributions:

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+"://platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

console.log('Rob Info Shortcode Source:', jQuery('*[data-rob-info]').html());

var pfHeaderImgUrl = 'http://www.dbalawyers.com.au/wp-content/uploads/2010/10/header_pdf.bmp';

var pfHeaderTagline = '';

var pfdisableClickToDel = '1';

var pfImagesSize = 'full-size';

var pfImageDisplayStyle = 'right';

var pfEncodeImages = '0';

var pfShowHiddenContent = '0';

var pfDisableEmail = '0';

var pfDisablePDF = '0';

var pfDisablePrint = '0';

var pfCustomCSS = "http://www.dbalawyers.com.au/wp-content/themes/canvasChild/printfriendly.css?v8";

var pfPlatform = 'WordPress';

(function($){

$(document).ready(function(){

if($('.pf-button-content').length === 0){

$('style#pf-excerpt-styles').remove();

}

});

})(jQuery);

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/hoverIntent.js

var uberMenuSettings = {"speed":"100","trigger":"hoverIntent","orientation":"horizontal","transition":"slide","hoverInterval":"20","hoverTimeout":"400","removeConflicts":"on","autoAlign":"off","noconflict":"off","fullWidthSubs":"off","androidClick":"off","iOScloseButton":"on","loadGoogleMaps":"off","repositionOnLoad":"off"};

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/ubermenu.min.js

https://www.dbalawyers.com.au/wp-includes/js/comment-reply.min.js

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/swv/js/index.js

var wpcf7 = {"api":{"root":"https:\/\/www.dbalawyers.com.au\/wp-json\/","namespace":"contact-form-7\/v1"},"cached":"1"};

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/js/index.js

var fsb = {"ajax":"https:\/\/www.dbalawyers.com.au\/wp-admin\/admin-ajax.php","nonce":"22b8cc0fa3"};

https://www.dbalawyers.com.au/wp-content/plugins/floating-social-bar/js/fsb.js

window.addEventListener("load", function(event) {

jQuery(".cfx_form_main,.wpcf7-form,.wpforms-form,.gform_wrapper form").each(function(){

var form=jQuery(this);

var screen_width=""; var screen_height="";

if(screen_width == ""){

if(screen){

screen_width=screen.width;

}else{

screen_width=jQuery(window).width();

} }

if(screen_height == ""){

if(screen){

screen_height=screen.height;

}else{

screen_height=jQuery(window).height();

} }

form.append('<input type="hidden" name="vx_width" value="'+screen_width+'">');

form.append('<input type="hidden" name="vx_height" value="'+screen_height+'">');

form.append('<input type="hidden" name="vx_url" value="'+window.location.href+'">');

});

});

stLight.options({publisher: "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", doNotHash: false, doNotCopy: false, hashAddressBar: false});

var options={ "publisher": "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", "position": "right", "ad": { "visible": false, "openDelay": 5, "closeDelay": 0}, "chicklets": { "items": ["facebook", "googleplus", "twitter", "linkedin", "email", "sharethis"]}};

https://www.dbalawyers.com.au/wp-content/themes/canvasChild/js/jquery.cycle2.min.js