Overview

A new commercial and industrial property (C&I Property) tax of 1% p.a. applies in Victoria from 1 July 2024. This new tax will be levied on the land’s unimproved value and is payable in addition to any land tax. Duty on the purchase of C&I Property will be phased out.

This article reflects the guidance material from the Victorian Treasury issued on 11 December 2023. While the new tax is not yet law and the details below may change before the legislation is finalised, there is limited time and opportunity to plan ahead. This article provides a brief snapshot on this new tax.

Duty regime before 1 July 2024

When purchasing real estate in Victoria prior to 1 July 2024 (including residential and C&I Property) a purchaser is required to pay land transfer duty. This is a substantial up-front cost to the purchase of real estate in Victoria (typically up to 6% of the purchase price). Most other states and territories in Australia also levy duty on real estate transfers. Land transfer duty is commonly referred to as stamp duty and we refer to the term ‘duty’ below, for simplicity.

Transitioning from duty to the new tax

C&I Property that is sold or transferred from 1 July 2024 will trigger a 10-year transition period. The new regime phases out the up-front cost of duty and, instead the first time that C&I Property is sold or transferred on or after 1 July 2024, the purchaser will have the choice to either:

a.) pay duty as a lump sum up-front payment; or

b.) pay the value of the duty over a 10-year period with a government-facilitated loan (Vic Loan) plus interest.

Regardless of which option the purchaser chooses, the 10-year transition period will begin from the date of the first transaction (eg, sale or transfer) on or after 1 July 2024.

Example

Trang purchases an office on 1 September 2024 (assuming that this office has not previously been sold or transferred after 30 June 2024) then this is the date that the 10-year transition period starts.

Trang can choose to either pay the duty up-front or apply for a Vic Loan to pay the duty over a 10 year period plus interest.

During this 10-year transition period, a subsequent sale of that property will not incur duty, nor will it incur the new tax until the 10-year transition period has concluded. However, after the 10-year transition period, the new 1% p.a. tax will be payable by the owner.

If Trang, for example, obtained a Vic Loan and then sold 5 years later, eg, on 1 September 2029, they are required to repay the balance of the loan and interest at that time.

Interestingly, the person who buys the office within that 10-year transition period will not have to pay duty nor the new 1% pa. tax until 1 September 2034 (being 10 years after Trang purchased the office).

Thus, the first purchaser of C&I Property from 1 July 2024 onwards is responsible for paying duty. Somewhat surprisingly however the second or subsequent purchaser (if they purchase the property within the 10-year transition period) gets a “free kick” in terms of not having to pay duty (provided the property continues to have a commercial or industrial use) nor do they have to pay the new 1% p.a. tax until after the 10-year transition period ceases.

While many may seek to retain a C&I Property for the longer-term, various reasons may arise resulting in a sale or transfer within the 10-year transition period (eg, cash flow or a move to more suitable premises). This may result in plenty of free kicks!

Annual property tax after the 10-year transition period

After the 10-year transition period, the new tax will be payable by the owner of the property. This tax is calculated at 1% p.a. of the unimproved value of the land and will be in addition to any land tax. Like land tax, the new tax will not be able to be passed on to retail tenants (as defined in the Retail Leases Act 2003 (Vic)).

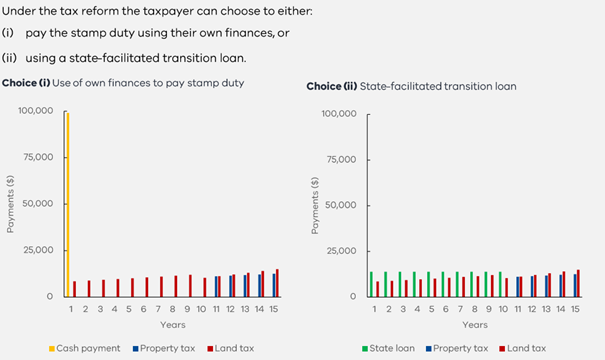

Diagram showing stamp duty options for the purchaser

The Victorian Department of Treasury and Finance has provided the following diagram to illustrate how the new tax applies.

1

Impact on SMSFs

Self managed superannuation fund (SMSF) trustees that invest into C&I Property from 1 July 2024 will need to be aware of how this new tax will work. This includes:

- If the property has not yet entered into the 10-year transition period and the SMSF is purchasing the property outright (ie, without borrowing), then the SMSF trustee will be required to pay the duty up-front as a Vic Loan borrowing will most likely result in a charge being placed on the property in contravention of regulation 13.14 Superannuation Industry (Supervision) Regulations 1994 (Cth).

- If the property has entered the 10-year transition period, the SMSF trustee should be aware of whether there is any “free kick” period remaining on that property.

- If the 10-year transition period has expired and is over, then the SMSF trustee will have to pay the new 1% p.a. tax on the unimproved value of the property.

Q&A

The Victorian Department of Treasury released a Q&A that sought to provide clarification on how this new property tax will work in practice. Below we summarise several key points.

- Where the property has multiple uses (eg, part commercial and part residential), the primary factor as to whether the property is affected by the reform is the sole or primary use of the property.

- Certain C&I Properties may qualify for an exemption eg, transfers of property from a deceased estate.

- Where a C&I Property is subsequently rezoned and becomes residential, a change of use duty may apply. Conversely, where a residential property converts to a C&I Property an adjustment to the new regime applies.

Exceptions

The new tax does not apply to:

- C&I Property acquired before 1 July 2024.

- Residential property.

- Property primarily used for primary production.

Planning

If there is a proposed transfer or sale of C&I Property planned in the near future expert advice should be obtained as this new tax may have impact on the property’s value. Those thinking of transferring to a related party or restructuring should consider whether a transfer prior to 30 June 2024 has any advantages or disadvantages compared to a transfer afterwards.

Conclusions

This new tax regime will have a substantial impact on the potential attractiveness of C&I Property in Victoria. Indeed, there are a range of other new and increased taxes in Victoria which is adversely impacting property investments in this state.

Importantly, purchasers should analyse how this new tax impacts their cash flow and whether the acquisition remains economically viable especially in the current commercial property market where returns on some commercial properties has decreased due to increased costs and taxes, especially land tax. In Victoria a 2.65% land tax rate applies for the 2024 calendar year for land value above $3 million. After the 10-yer transition period, this will result in a 3.65% p.a. rate resulting in $36,500 p.a. for land tax and the new 1% tax for each $1,000,000 of land value above $3,000,000.

Naturally, DBA Lawyers would be pleased to assist and provide advice.

Subsequent to this article, the Victorian Government introduced the Commercial and Industrial Property Tax Reform Bill 2024 (Bill). This article does not refer to the Bill and is based on our understanding of the potential law as of 27 February 2024. If the Bill becomes law, we will prepare an updated article.

Related articles

* * *

This article is for general information only and should not be relied upon without first seeking advice from an appropriately qualified professional. The above does not constitute financial product advice. Financial product advice can only be obtained from a licenced financial adviser under the Corporations Act 2001 (Cth).

Note: DBA Lawyers presents monthly online SMSF training. For more details or to register, visit www.dbanetwork.com.au or call 03 9092 9400.

For more information regarding how DBA Lawyers can assist in your SMSF practice, visit www.dbalawyers.com.au.

By Daniel Butler, Director ([email protected]) and Nick Walker, Lawyer ([email protected]).

DBA LAWYERS

27 February 2024

____________________________________________

1 Department of Treasury and Finance (Vic), Landmark Tax Reform Transition Away From Stamp Duty For Commercial and Industrial Properties, Factsheet (2023) 2.