Overview

This article provides a brief summary of the excess contributions tax (‘ECT’) regime. It also summarises the latest developments including the May 2014 Federal Budget announcement, the latest statistical information and covers several key recommendations made by the Inspector-General of Taxation (‘IGT’).

Brief summary

The ECT regime was introduced in July 2007 as a system designed to discourage people exceeding their contribution caps. It has undergone a number of changes to make it fairer and more flexible.

There are two caps that seek to limit contributions. The first is for concessional contributions (‘CC’) and the second is for non-concessional contributions (‘NCC’). Note, however, that both these caps can be exceeded provided the member is prepared to pay the applicable amount of ECT.

Since mid-2013, excess CCs are included in the member’s assessable income and taxed at their marginal tax rate (‘MTR’). The member receives a 15% tax offset (as 15% contributions tax should have been paid by the fund on that contributed amount). Prior to 30 June 2013, excess CCs were generally subject to 46.5% tax (being a 15% tax on assessable contributions plus a 31.5% ECT rate).

Effective from mid-2013, it is proposed that a member will be permitted to withdraw their excess NCCs to avoid a 46.5% ECT (which is expected to increase to 49% from 1 July 2014 with the Temporary Budget Repair Levy and the 0.5% increase to the medicare levy). Any associated earnings on excess NCCs will be included in the member’s assessable income and taxed at their marginal tax rate. Naturally, this assumes the announcements in the 2014 Federal Budget are enacted as published. Prior to these announcements, the ECT on excess NCCs prior to 30 June 2013 was 46.5%. It is worthwhile noting here that NCCs were also generally from a member’s after-tax money.

Prior to mid-2013, the maximum rate of ECT was 93%. Australia has the highest effective tax rate on superannuation out of all countries in the world! Indeed, Professor Robert Deutsch, Deputy President of the Administrative Appeals Tribunal stated in Verschuer and Commissioner of Taxation [2013] AATA 12 at [61]:

whilst this [78%, being 31.5% + 46.5%] is clearly a rate of tax that is itself unacceptably high by almost every standard (with the possible exception of recently announced French taxes), it is the prescribed outcome declared in unambiguous terms by the Federal Parliament.

The maximum 93% ECT tax rate that was possible prior to mid 2013 is calculated as follows:

| Tax rate % | |

| Contributions tax on CC | 15.0 |

| ECT on excess CC | 31.5 |

| ECT on excess NCC | 46.5 |

| Total | 93.0% |

The position from 1 July 2013 will look considerably better as:

- there is no longer any ECT on excess CCs (as discussed above, the excess CCs are included in the member’s assessable income and taxed at their MTR); and

- there is not likely to be any ECT on excess NCCs since 1 July 2013 as a member has the option to withdraw any excess (ECT will only be payable on any excess NCC retained in the super system).

Inspector-General of Taxation’s Review into ECT

The IGT ‘Review into the ATO’s compliance approach to individual taxpayers — superannuation excess contributions tax’ (IGT Report) was finalised in March 2014.

First, I summarise some interesting points arising from my review of the statistical information included in the IGT Report. Secondly, I discuss several important recommendations made by the IGT for improving the ECT regime.

Statistical information

The IGT Report reveals some interesting statistical information including the following:

- broadly, around 53% of objections to ECT assessments were disallowed and around 47% were allowed in full or part (refer 1.92).

- there have been some 31 matters that have proceeded on to the AAT or the Federal Court and of these, some 6 were decided in favour of the ATO, 12 were settled by agreement, 8 were withdrawn or conceded and 5 were still in progress (refer 1.93).

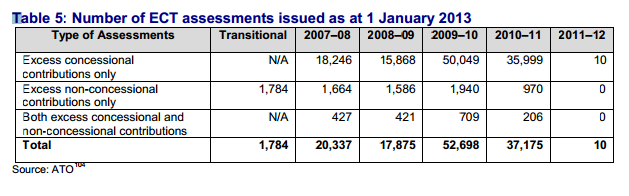

- the following ‘Table 5: Number of ECT assessments issued as at 1 January 2013’ is extracted from the report at [2.5]:

The highest number of ECT assessments was in 2009-10 with over 50,000 excess CC assessments. The ATO has not finalised all its ECT assessments for 2010-11 and has only issued a small number of ECT assessments for 2011-12.

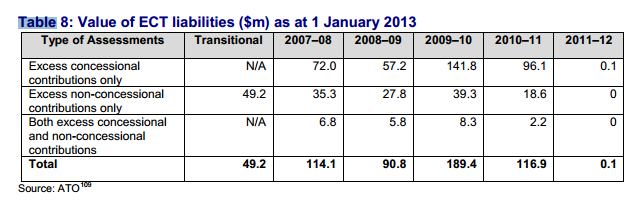

- the following ‘Table 8: Value of ECT Liabilities ($m) as at 1 January 2013’ is extracted from the report at [2.14]:

This shows the total value of ECT assessments from the commencement of the ECT system to FY2010-11. The highest ECT raised was a total of $189.4m for FY2009-10.

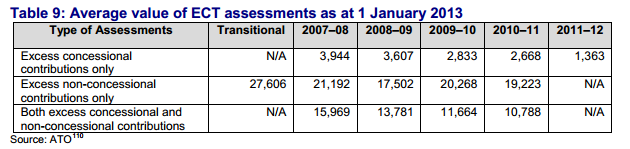

- the following ‘Table 9: Average value of ECT assessments as at 1 January 2013’ is extracted from the report at [2.17]:

This shows the average value of excess CC assessments being less than $3,000 during the period of 2009-10 to 2011-12 whereas the average value of NCC assessments was around $20,000 for this same period.

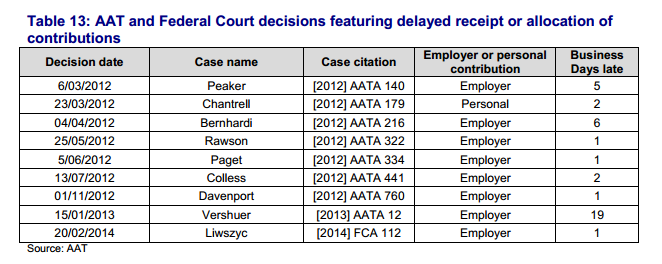

- the following ‘Table 13: AAT and Federal Court decisions featuring delayed receipt of allocation of contributions’ is extracted from the report at [2.64]:

The 9 cases that are summarised in this table reveal that a short delay by an employer close to the end of a financial year in making or allocating a contribution can result in a significant ECT assessment. For example, the employer was 1 day late in the Davenport decision despite the fund receiving the contribution on 30 June and the employee’s identification was not located by the fund until 1 July. Nevertheless, the member was assessed to ECT and the short delay did not constitute special circumstances.

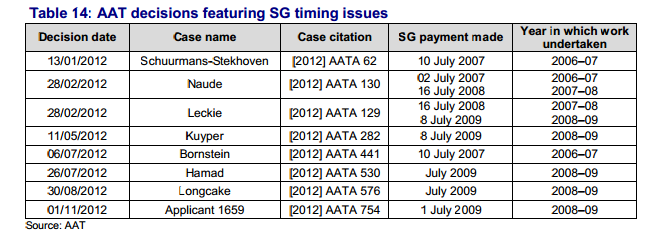

- the following ‘Table 14: AAT decisions featuring SG timing issues’ is extracted from the report at [2.72]:

This table summaries 8 decisions where employer superannuation guarantee (‘SG’) contributions involved timing issues resulting in ECT disputes in the AAT. Only 3 were successful in having their contributions disregarded or reallocated (ie, Bornstein, Hamad and Longcake).

IGT recommendations

Most of the IGT’s recommendations are aimed at improving the overall effectiveness of the ECT regime having regard to how it impacts taxpayers and I will therefore not discuss them here. It is worth noting that the ATO has generally agreed with all of the IGT’s recommendations either in full or part.

The IGT has also made, among other, the following recommendations:

- for the ATO to update its public guidance on genuine mistakes leading to excess contributions to inform taxpayers of circumstances in which mistakes can be effectively corrected or not. The IGT Report notes that the ATO material is ambiguous as only certain mistakes will qualify for rejection. This is another area of the law where further flexibility is required in addition to the ability to withdraw excess NCCs. The ATO’s current ‘special circumstances’ discretion in section 291-465 with respect to excess CCs and section 292-465 with respect to excess NCCs is too inflexible for many human errors and oversights which are not been considered unusual or out of the ordinary. Currently, a taxpayer is required to convince the Commissioner that special circumstances exist; which is a very difficult test to satisfy as reflected in many adverse decisions against taxpayers (see tables 13 and 14 above by way of example). Another more flexible test is required to deal with these special circumstances.

- the IGT recommended that the ATO publish details on its use of the de minimis test whereby excess contributions below a certain amount are disregarded and that the threshold amounts be disclosed. The ATO disagreed with this recommendation and was of the view that such disclosure will lead to this test being abused. The ATO will therefore publish general information only. My view is that the ATO should disclose these details including the threshold amounts and monitor taxpayer behaviour and follow up on specific taxpayers who may be abusing the threshold.

- the IGT has recommended the ATO seek an appropriate case to test, via court litigation, the effectiveness of contributions limiting or rejection clauses in superannuation fund deeds that are designed to reject or limit an excess contribution. This topic was first raised by the ATO in TA 2010/2 issued in early 2010 and this taxpayer alert was subsequently withdrawn in November 2011 and replaced by an ATO fact sheet. The topic was then to become the subject of a legislative solution as announced in the 2011-12 Mid-Year Economic Fiscal Outlook. This announced (but unenacted) measure was then withdrawn by Mr Joe Hockey on 14 December 2013. Thus, there is no express prohibition on the inclusion of these clauses in superannuation deeds. Indeed, there are sound reasons to include such provisions to minimise ECT risks. Thus, there is likely to be a renewed interest in these provisions being included in SMSF deeds and the opportunity for these to be tested before the courts. Trustees should always act in the best financial interests of their members and comply with the relevant terms in the trust deed.

Conclusions

While we should now have a far better system, careful ongoing management of contribution strategies is still needed to minimise ECT risks.

* * *

This article is for general information only and should not be relied upon without first seeking advice from an appropriately qualified professional.