window._wpemojiSettings = {"baseUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/72x72\/","ext":".png","svgUrl":"https:\/\/s.w.org\/images\/core\/emoji\/15.0.3\/svg\/","svgExt":".svg","source":{"concatemoji":"https:\/\/www.dbalawyers.com.au\/wp-includes\/js\/wp-emoji-release.min.js?ver=27fe84cc702a2d02d851b8f2a8bba567"}};

/*! This file is auto-generated */

!function(i,n){var o,s,e;function c(e){try{var t={supportTests:e,timestamp:(new Date).valueOf()};sessionStorage.setItem(o,JSON.stringify(t))}catch(e){}}function p(e,t,n){e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(t,0,0);var t=new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data),r=(e.clearRect(0,0,e.canvas.width,e.canvas.height),e.fillText(n,0,0),new Uint32Array(e.getImageData(0,0,e.canvas.width,e.canvas.height).data));return t.every(function(e,t){return e===r[t]})}function u(e,t,n){switch(t){case"flag":return n(e,"\ud83c\udff3\ufe0f\u200d\u26a7\ufe0f","\ud83c\udff3\ufe0f\u200b\u26a7\ufe0f")?!1:!n(e,"\ud83c\uddfa\ud83c\uddf3","\ud83c\uddfa\u200b\ud83c\uddf3")&&!n(e,"\ud83c\udff4\udb40\udc67\udb40\udc62\udb40\udc65\udb40\udc6e\udb40\udc67\udb40\udc7f","\ud83c\udff4\u200b\udb40\udc67\u200b\udb40\udc62\u200b\udb40\udc65\u200b\udb40\udc6e\u200b\udb40\udc67\u200b\udb40\udc7f");case"emoji":return!n(e,"\ud83d\udc26\u200d\u2b1b","\ud83d\udc26\u200b\u2b1b")}return!1}function f(e,t,n){var r="undefined"!=typeof WorkerGlobalScope&&self instanceof WorkerGlobalScope?new OffscreenCanvas(300,150):i.createElement("canvas"),a=r.getContext("2d",{willReadFrequently:!0}),o=(a.textBaseline="top",a.font="600 32px Arial",{});return e.forEach(function(e){o[e]=t(a,e,n)}),o}function t(e){var t=i.createElement("script");t.src=e,t.defer=!0,i.head.appendChild(t)}"undefined"!=typeof Promise&&(o="wpEmojiSettingsSupports",s=["flag","emoji"],n.supports={everything:!0,everythingExceptFlag:!0},e=new Promise(function(e){i.addEventListener("DOMContentLoaded",e,{once:!0})}),new Promise(function(t){var n=function(){try{var e=JSON.parse(sessionStorage.getItem(o));if("object"==typeof e&&"number"==typeof e.timestamp&&(new Date).valueOf()<e.timestamp+604800&&"object"==typeof e.supportTests)return e.supportTests}catch(e){}return null}();if(!n){if("undefined"!=typeof Worker&&"undefined"!=typeof OffscreenCanvas&&"undefined"!=typeof URL&&URL.createObjectURL&&"undefined"!=typeof Blob)try{var e="postMessage("+f.toString()+"("+[JSON.stringify(s),u.toString(),p.toString()].join(",")+"));",r=new Blob([e],{type:"text/javascript"}),a=new Worker(URL.createObjectURL(r),{name:"wpTestEmojiSupports"});return void(a.onmessage=function(e){c(n=e.data),a.terminate(),t(n)})}catch(e){}c(n=f(s,u,p))}t(n)}).then(function(e){for(var t in e)n.supports[t]=e[t],n.supports.everything=n.supports.everything&&n.supports[t],"flag"!==t&&(n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&n.supports[t]);n.supports.everythingExceptFlag=n.supports.everythingExceptFlag&&!n.supports.flag,n.DOMReady=!1,n.readyCallback=function(){n.DOMReady=!0}}).then(function(){return e}).then(function(){var e;n.supports.everything||(n.readyCallback(),(e=n.source||{}).concatemoji?t(e.concatemoji):e.wpemoji&&e.twemoji&&(t(e.twemoji),t(e.wpemoji)))}))}((window,document),window._wpemojiSettings);

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery.min.js

https://www.dbalawyers.com.au/wp-includes/js/jquery/jquery-migrate.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/third-party.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/modernizr.min.js

https://www.dbalawyers.com.au/wp-content/themes/canvas/includes/js/general.min.js

jQuery(document).ready(function($){

// Check if the body has the specified class

if($('body.postid-15293').length) {

// If it does, replace the HTML content of h1.title.entry-title

$('h1.title.entry-title').html('<h1 class="title entry-title">New decision highlights options for disqualified persons: <i>Barry, in the matter of an application by Barry</i> [2024] FCA 13</h1>');

}

});

jQuery(document).ready(function( $ ){

$('.attachmentid-2444 p.attachment a').attr('href','https://www.dbalawyers.com.au/stamping_memo.pdf');

});

/* Default comment here */

jQuery(document).ready(function( $ ){

$(".page-id-3527 .post-12207 img").attr("src","/wp-content/uploads/2021/05/CPA-Logo-1400x656-2-e1621498237883.jpg");

});

jQuery(document).ready( function($){

$( '.responsiveMenuSelect' ).change(function() {

var loc = $(this).find( 'option:selected' ).val();

if( loc != '' && loc != '#' ) window.location = loc;

});

//$( '.responsiveMenuSelect' ).val('');

});

var switchTo5x=true;

Transfer balance cap As the key super reforms (primarily contained in the Treasury Laws Amendment (Fair and Sustainable Superannuation) Act 2016 (Cth)) is now law, it is an ideal time to consider the impact of the superannuation reforms on succession planning. The focus of this article is the interaction between pensions payable to minor children [read more]

A trap exists in the difference between a new Act and the previous exposure draft version of the Act’s Bill that had been circulated. The trap relates to certain CGT relief. On its face, many people will choose to use the CGT relief. However, for some it could be a step backwards. Accordingly, it is [read more]

Superannuation law is currently undergoing one of the most significant periods of change in almost a decade. This has led to practitioners having to reconsider the conventional wisdom on various issues relating to superannuation. One such area where previous standard practice needs to be revisited is succession planning. In this article I want to focus [read more]

On Friday 14 October 2016, Treasury released the third tranche of draft legislation to implement the announcements in the Federal Budget. The principal component of this tranche was the new non-concessional contribution rules. Hidden in the legislation is a very important concession. I envisage that advisers will only need to apply it a handful of times [read more]

Introduction The Department of Treasury on 27 September 2016 released the second tranche of exposure draft legislation and explanatory material in relation to the Federal Government’s proposed superannuation reforms. These materials provide long-awaited detail on the workings of the $1.6 million transfer balance cap measure. This article explains some key take-away points about this measure. [read more]

Treasury has released the exposure draft of the Bill that would introduce the $1.6 million transfer balance cap. The draft legislation answers a vital question: what does the $1.6 million transfer balance cap mean for succession planning? (Note that this article is premised on the very dangerous assumption that the ultimate legislation will look exactly [read more]

By: Daniel Butler, Director, DBA Lawyers On 15 September 2016 the Government, following four months of considerable adverse feedback on its $500,000 lifetime non-concessional contributions (‘NCCs’) cap proposal announced on 3 May 2016, has decided to drop this measure (which was retroactive to 1 July 2007) for a more palatable and prospective contributions limit that [read more]

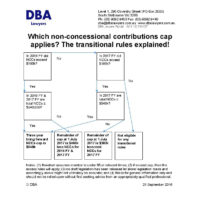

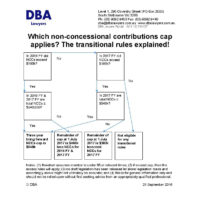

I have put together this flowchart explaining the new non-concessional contribution (‘NCC’) rules, in particular how clients will transition to the new rules come 1 July 2017. I suspect all advisers will have clients for whom this information is relevant and many client might want to make large NCCs before 1 July 2017. We will [read more]

We are about to enter a period of substantial reform. We have therefore prepared a brief ‘stock take’ of what the reform proposals look like as at the start of July 2016. In particular, we consider the proposals announced in the 3 May 2016 Federal Budget by the Liberal Government. We also briefly compare these [read more]

ATO extends the deadline to 31 January 2017 The ATO extension to 31 January 2017 is most welcome to alleviate the concerns that many SMSFs are facing in view of the need to act swiftly to clean up related party and non-bank limited recourse borrowing arrangements (‘LRBA’). Many SMSFs in particular have had to look [read more]

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+"://platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs");

console.log('Rob Info Shortcode Source:', jQuery('*[data-rob-info]').html());

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/hoverIntent.js

var uberMenuSettings = {"speed":"100","trigger":"hoverIntent","orientation":"horizontal","transition":"slide","hoverInterval":"20","hoverTimeout":"400","removeConflicts":"on","autoAlign":"off","noconflict":"off","fullWidthSubs":"off","androidClick":"off","iOScloseButton":"on","loadGoogleMaps":"off","repositionOnLoad":"off"};

https://www.dbalawyers.com.au/wp-content/plugins/ubermenu/core/js/ubermenu.min.js

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/swv/js/index.js

var wpcf7 = {"api":{"root":"https:\/\/www.dbalawyers.com.au\/wp-json\/","namespace":"contact-form-7\/v1"},"cached":"1"};

https://www.dbalawyers.com.au/wp-content/plugins/contact-form-7/includes/js/index.js

window.addEventListener("load", function(event) {

jQuery(".cfx_form_main,.wpcf7-form,.wpforms-form,.gform_wrapper form").each(function(){

var form=jQuery(this);

var screen_width=""; var screen_height="";

if(screen_width == ""){

if(screen){

screen_width=screen.width;

}else{

screen_width=jQuery(window).width();

} }

if(screen_height == ""){

if(screen){

screen_height=screen.height;

}else{

screen_height=jQuery(window).height();

} }

form.append('<input type="hidden" name="vx_width" value="'+screen_width+'">');

form.append('<input type="hidden" name="vx_height" value="'+screen_height+'">');

form.append('<input type="hidden" name="vx_url" value="'+window.location.href+'">');

});

});

stLight.options({publisher: "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", doNotHash: false, doNotCopy: false, hashAddressBar: false});

var options={ "publisher": "5bec7acf-cc01-4bd5-8596-0c6a1ca47d2d", "position": "right", "ad": { "visible": false, "openDelay": 5, "closeDelay": 0}, "chicklets": { "items": ["facebook", "googleplus", "twitter", "linkedin", "email", "sharethis"]}};

https://www.dbalawyers.com.au/wp-content/themes/canvasChild/js/jquery.cycle2.min.js